Thirdfort ID Verification Checks

Next-level verification with Thirdfort Enhanced NFC ID

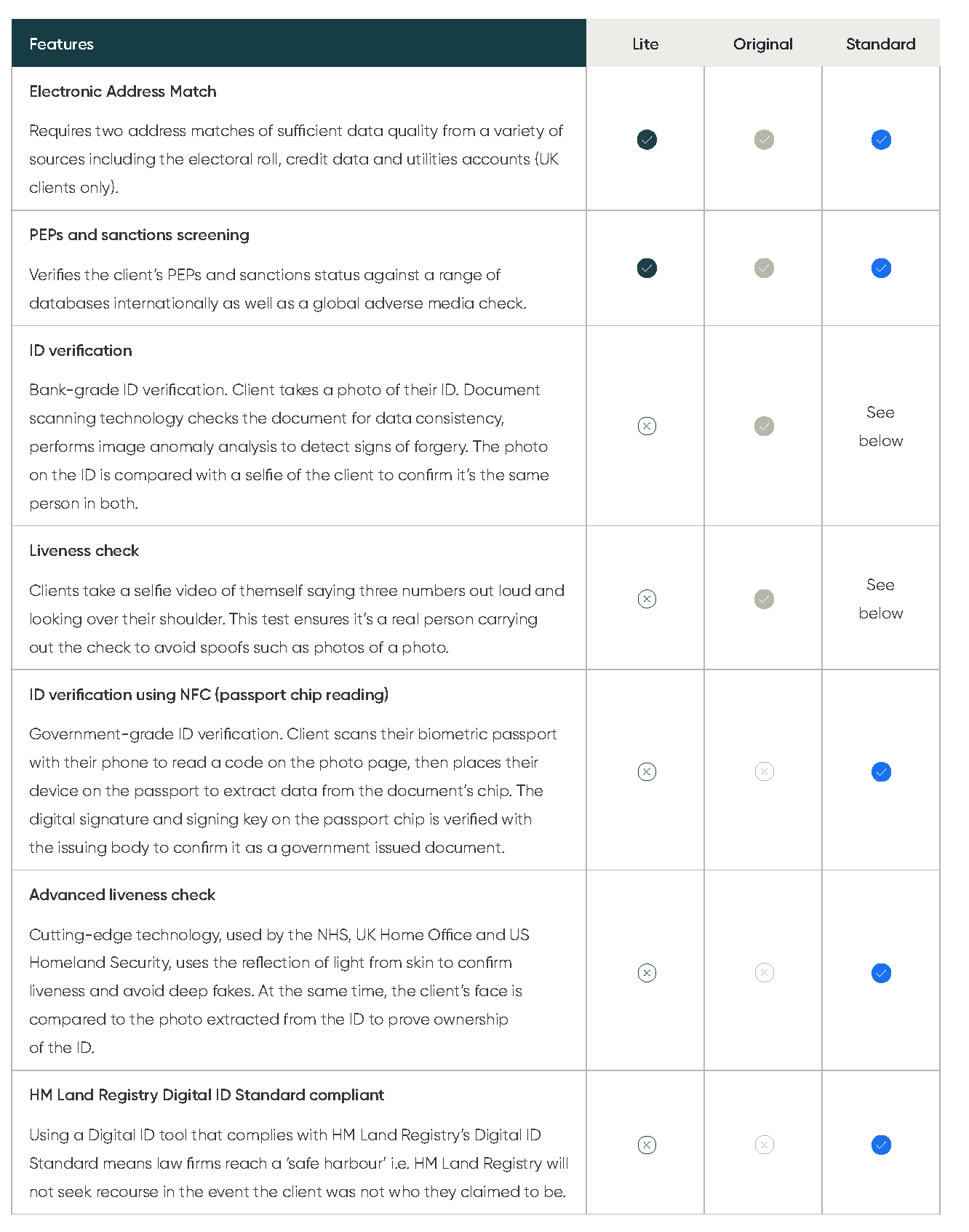

As fraudsters evolve, so must your defences. Thirdfort Enhanced NFC ID is designed to keep you one step ahead, with the most advanced NFC-powered Id verification technology on the market. Built to meet HM Land Registry’s Digital ID Standard, it protects your firm from the risks of identity fraud while delivering seamless client experiences.

Key benefits:

- Thirdfort’s average check completion time is just 14 hours

- Award-winning support: Thirdfort’s dedicated support team manages all customer queries related to KYC, AML, and SoF, helping conveyancers save time and reduce costs so they can focus on their core work.

- You only pay for completed checks

How It Works: Five steps to secure, compliant ID verification

- Quick & easy document scan

Your client simply scans the MRZ (Machine Readable Zone) on their ePassport using the Thirdfort app. This unlocks secure access to the data stored on the document’s NFC chip. - NFC powered data extraction

With a tap of their phone to the passport, Thirdfort’s app reads encrypted data directly from the chip, cutting out forgery risks. - Instant government level verification

We validate the chip’s digital signature and signing key in real time against official government records. This critical step ensures your checks align with HM Land Registry’s highest standard. - Biometric and liveness Checks

State-of-the-art video technology confirms that your client is a real, live person—not a deepfake, video, or photo. Advanced biometrics then compare their selfie to the passport photo for a perfect match. - Instant ID Verification Report

You receive a clear, easy-to-read PDF report via your portal, outlining each check passed or failed,delivered in seconds.

Why It works: Real people, verified in real time

- The right person

Is this person’s face a match with their ID? - A real person

Are they physically present—not a mask, image, or spoof? - Right now

Is this a live check happening in real time, not a replay?

Protect your firm. Impress your clients. Reduce your risk.

Reach HM Land Registry’s ‘safe harbour’

Conforming with HM Land Registry’s Digital ID guidelines holds significant value for legal firms as it guarantees ‘safe harbour’ from legal recourse if there is identity fraud in a property transaction.

A key requirement of the Digital ID Standard is NFC powered identity verification. Thirdfort Standard now allows our customers to access this advanced technology. There are other providers which can read NFC chip data, however, our product takes things much further with the ability to verify the chip’s digital signature and signing key with the issuing government body in real time, as required by HM Land Registry. Accurate, up-to-date information, all in one place.

Bring government-grade ID verification to your firm

Interested in how Thirdfort Standard can protect your firm from even the most sophisticated criminal attacks? Want to learn how to gain ‘safe harbour’ from recourse by HM Land Registry?

Request a call back from a professional and experienced conveyancing search specialist